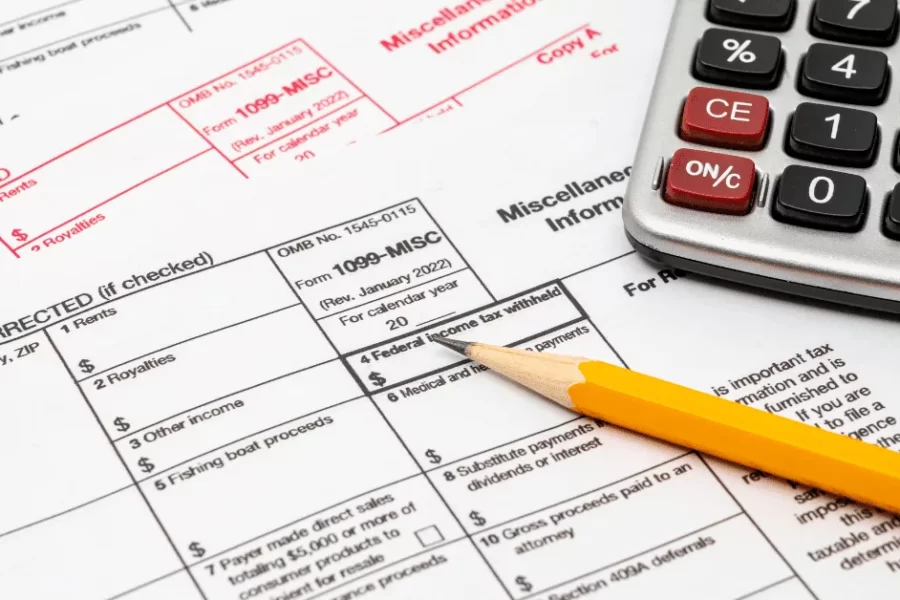

The 1099 form stands as a crucial document in the realm of U.S. tax reporting, playing a pivotal role in ensuring financial transparency between payers and recipients of various income streams. As taxpayers navigate the intricate landscape of financial documentation,…

Matthew RusselFebruary 27, 2024