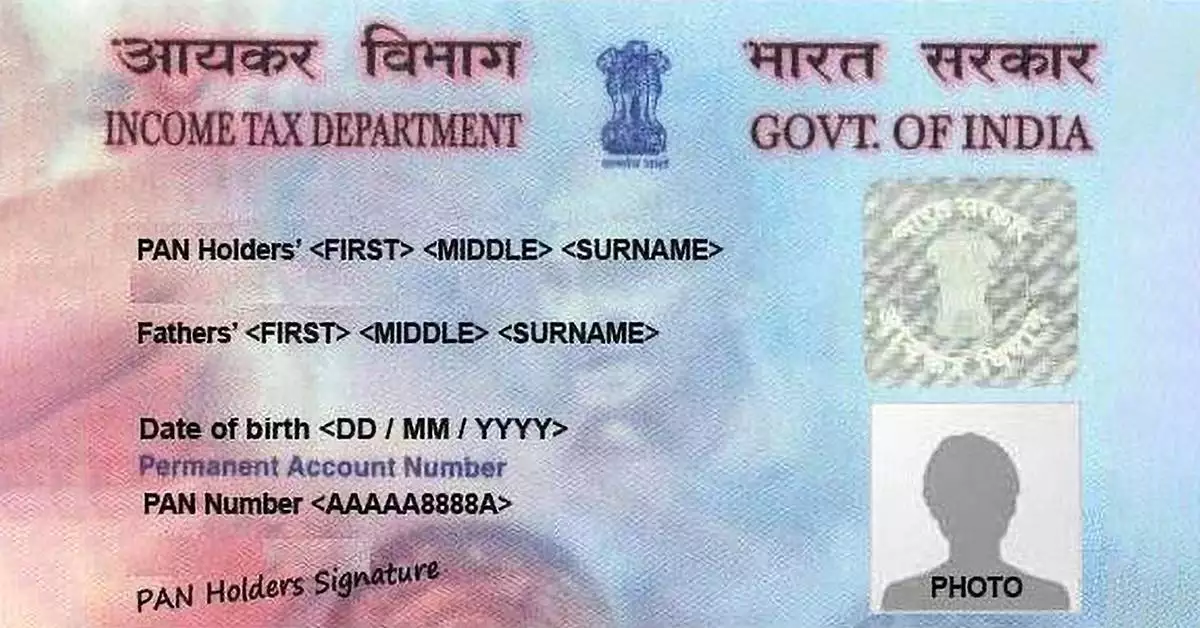

A PAN card, or Permanent Account Number card, is a unique 10-digit alphanumeric identification number issued by the Indian Income Tax Department. Having a PAN card is mandatory for a wide range of financial transactions, including opening a bank account, filing taxes, and investing in securities. The minimum age for obtaining a PAN card is an important eligibility criteria for individuals and entities looking to obtain one.

In this blog, we will discuss the minimum age requirement for a PAN card, the reasoning behind it, and other important eligibility criteria you need to be aware of. Additionally, we’ll guide you through the process of how to apply for a PAN card, including the steps involved and required documentation.

Whether you are an individual, Hindu Undivided Family (HUF), company, or another type of entity, make sure you understand the minimum age requirement for a PAN card and the process of obtaining one.

Minimum Age Requirement

What Is The Minimum Age For A Pan Card?

The Permanent Account Number (PAN) card is a unique 10-digit alphanumeric identification number issued by the Indian Income Tax Department. It is a crucial document for financial transactions, including opening a bank account, investing in securities, and filing taxes. To obtain a PAN card, individuals and entities must meet certain eligibility criteria, including the minimum age requirement.

The minimum age requirement to apply for a PAN card is 18 years old. This age limit has been set by the Indian government to ensure that individuals are old enough to engage in financial transactions and understand the responsibilities that come with having a PAN card. The PAN card serves as a personal identification number and is linked to an individual’s financial records, so it is important that they are mature enough to handle such information responsibly.

In addition to the minimum age requirement, individuals and entities must also meet other eligibility criteria to obtain a PAN card. For instance, they must be Indian citizens or a foreign national residing in India. The type of entity (individual, Hindu Undivided Family (HUF), company, etc.) also plays a role in determining the eligibility criteria for a PAN card.

Once you have determined that you meet the minimum age requirement and other eligibility criteria, you can begin the process of obtaining a PAN card. You can apply for a PAN card online or offline, depending on your preference. The process involves filling out an application form, submitting the required documentation, and paying the applicable fees.

Overall, the minimum age requirement to apply for a PAN card is 18 years old. This age limit is in place to ensure that individuals are mature enough to handle the responsibilities that come with having a PAN card. Make sure you meet the eligibility criteria and understand the process of obtaining a PAN card before beginning your application.

What Is The Reasoning Behind This Age Limit For A PAN Card?

The Indian government has set the minimum age requirement of 18 years old for obtaining a PAN card to ensure that individuals are mature enough to handle the responsibilities that come with having a PAN card. A PAN card serves as a personal identification number that is linked to an individual’s financial records, so it is important that they are mature enough to handle such information responsibly.

At the age of 18, individuals are considered to have reached the age of majority and are legally able to engage in financial transactions. By setting the minimum age limit at 18, the Indian government is ensuring that individuals have the maturity and understanding necessary to make informed decisions about their finances. This age limit also ensures that individuals have the ability to fully comprehend the consequences of their financial actions and are equipped to handle the responsibilities that come with having a PAN card.

Furthermore, the PAN card serves as a unique identification number for financial transactions and is a crucial document for several financial activities, including opening a bank account, investing in securities, and filing taxes. Setting the minimum age limit at 18 helps to prevent fraudulent activities, as individuals below this age may not have the maturity or understanding necessary to handle such responsibilities.

Eligibility Criteria For Getting A PAN Card

Citizenship Status For Permanent Account Number (PAN) Card In India

Citizenship status is one of the key eligibility criteria for obtaining a Permanent Account Number (PAN) card in India. The PAN card serves as a unique identification number for financial transactions and is a crucial document for several financial activities, including opening a bank account, investing in securities, and filing taxes.

To be eligible for a PAN card, individuals must be either Indian citizens or foreign nationals residing in India. Indian citizens can apply for a PAN card regardless of where they reside, while foreign nationals must be residing in India at the time of application. This eligibility criteria helps to prevent fraudulent activities and ensure that the PAN card is issued only to those who are legally allowed to engage in financial transactions in India.

It is important to note that the PAN card is not a substitute for citizenship or visa status. Individuals must have the proper citizenship or visa status before applying for a PAN card. In the case of foreign nationals, they must also have a valid visa for the duration of their stay in India.

Type Of Entity (Individual, HUF, Company, Etc.)

The type of entity is an important eligibility criteria for obtaining a Permanent Account Number (PAN) card in India. The PAN card serves as a unique identification number for financial transactions and is a crucial document for several financial activities, including opening a bank account, investing in securities, and filing taxes.

There are several different types of entities that can apply for a PAN card in India, including:

- Individuals: Any Indian citizen or foreign national residing in India can apply for a PAN card as an individual.

- Hindu Undivided Family (HUF): An HUF is a joint family structure that is recognized under Hindu law and can apply for a PAN card as a separate entity.

- Company: Companies registered in India, including private limited companies, public limited companies, and limited liability partnerships, can apply for a PAN card.

- Trust: Trusts, including charitable trusts, religious trusts, and family trusts, can apply for a PAN card.

- Partnership Firm: Partnership firms, including limited liability partnerships and general partnerships, can apply for a PAN card.

- Association of Persons (AOP): An AOP is a group of individuals who come together for a common purpose and can apply for a PAN card as a separate entity.

Each type of entity has different eligibility criteria and documentation requirements, so it is important to understand the requirements for your specific entity type before applying for a PAN card.

Other Eligibility Criteria For Obtaining A Pan Card

In addition to citizenship status, there are several other eligibility criteria for obtaining a Permanent Account Number (PAN) card in India. The PAN card serves as a unique identification number for financial transactions and is a crucial document for several financial activities, including opening a bank account, investing in securities, and filing taxes.

One of the key eligibility criteria for a PAN card is age. As previously mentioned, the minimum age requirement to apply for a PAN card is 18 years old. This age limit has been set by the Indian government to ensure that individuals are old enough to engage in financial transactions and understand the responsibilities that come with having a PAN card.

Another important eligibility criteria is the type of entity. The PAN card can be obtained by individuals, Hindu Undivided Family (HUF), company, trust, partnership firm, and other entities. Each type of entity has different eligibility criteria and documentation requirements, so it is important to understand the requirements for your specific entity type.

Individuals must also have a valid address proof and identification proof to apply for a PAN card. This can include a passport, driver’s license, Voter ID, or Aadhaar card. In addition, entities must provide their company registration or incorporation certificate as proof of their existence.

Lastly, the applicant must have a valid tax identification number (TIN) to apply for a PAN card. This number is issued by the Indian Income Tax Department and is required for several financial transactions, including filing taxes and investing in securities.

How To Apply For Pan Card?

Applying for a Permanent Account Number (PAN) card in India is a relatively straightforward process. The PAN card serves as a unique identification number for financial transactions and is a crucial document for several financial activities, including opening a bank account, investing in securities, and filing taxes.

Here are the steps to apply for a PAN card in India:

- Choose the right application form: The first step in the PAN card application process is to choose the right form. There are several forms available, including Form 49A for individuals and HUF, Form 49AA for foreign nationals, and Form 49B for companies and other entities.

- Gather necessary documents: Before submitting the application, you will need to gather several necessary documents, including proof of identity, proof of address, and proof of birth (if applicable).

- Fill out the application form: Once you have gathered all necessary documents, you can fill out the application form. Be sure to fill out all required information accurately and legibly.

- Submit the application: You can submit the PAN card application in several ways, including online, through a PAN center, or by mail. If you are submitting the application online, you will need to pay the application fee through a credit card, debit card, or net banking.

- Track your application status: After submitting the application, you can track its status online to ensure it is processing smoothly.

Overall, applying for a PAN card in India is a straightforward process. Choose the right form, gather necessary documents, fill out the application form, submit the application, and track its status to ensure a smooth and successful application process.

Required Documentation For Applying for a PAN card?

The Permanent Account Number (PAN) card is a crucial document for several financial activities in India, including opening a bank account, investing in securities, and filing taxes. Applying for a PAN card requires you to submit several necessary documents to verify your identity, address, and birth date (if applicable).

Here are the required documents for applying for a PAN card in India:

- Proof of identity: This can include government-issued ID cards such as a passport, voter ID card, driving license, or Aadhaar card.

- Proof of address: This can include utility bills, bank statements, or rent agreements that show your current address.

- Proof of birth: If you were born after 31st December, 1989, you will need to provide proof of birth, such as your birth certificate or school leaving certificate.

- Passport size photo: You will need to submit a recent passport-size photo to be included on your PAN card.

- Signature: You will need to provide a signature on the PAN card application form, which will be included on your PAN card.

Note: The specific documentation requirements for foreign nationals and companies may differ, so it is important to consult the appropriate PAN card application form for your entity type.

Available Options For Applying For A PAN Card? (Online, Offline, Etc.)

Applying for a Permanent Account Number (PAN) card in India is a crucial step in several financial activities, including opening a bank account, investing in securities, and filing taxes. There are several options available for applying for a PAN card, allowing you to choose the most convenient option for you.

Here are the available options for applying for a PAN card in India:

- Online: You can apply for a PAN card online by visiting the official website of the Income Tax Department of India. This is the most convenient option as you can complete the entire process from the comfort of your home or office.

- Through a PAN centre: You can also apply for a PAN card through a PAN center by visiting one in person. These centers are authorized by the Income Tax Department of India and can assist you with the application process.

- By mail: You can also apply for a PAN card by mail by sending the completed application form and necessary documents to the Income Tax Department of India.

No matter which option you choose, it is important to ensure that you submit all necessary information and documents accurately and legibly to avoid any delays in the process.

Conclusion

In conclusion, the minimum age requirement to obtain a Permanent Account Number (PAN) card in India is 18 years. The age limit is set to ensure that individuals are legally capable of entering into financial transactions and are responsible for their own financial affairs. This requirement applies to all entities, including individuals, Hindu Undivided Families (HUFs), companies, and foreign nationals.

In addition to meeting the age requirement, individuals and entities must also meet other eligibility criteria and provide necessary documentation, including proof of identity, address, and birth date (if applicable). There are several options available for applying for a PAN card, including online, through a PAN center, or by mail.

Having a PAN card is essential for several financial activities in India and is mandatory for most financial transactions, including opening a bank account, investing in securities, and filing taxes. Ensure that you meet the minimum age requirement and all other eligibility criteria before applying for a PAN card.